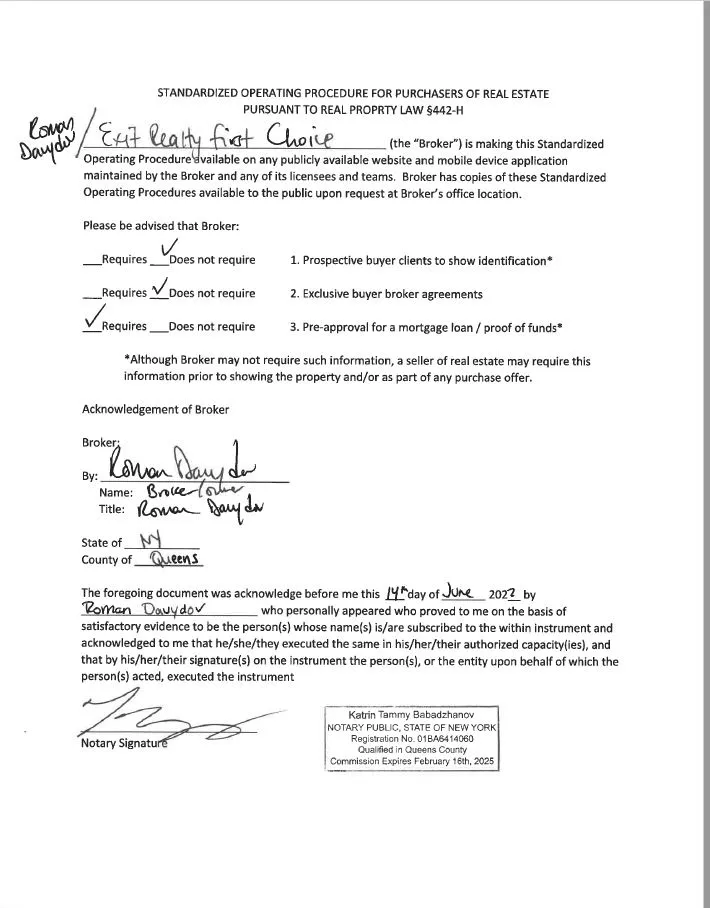

EXIT Realty First Choice

Your First Choice in Real Estate

EXIT Realty First Choice

Your First Choice in Real Estate

BUY A HOME

HOME EVALUATION

FEATURED LISTINGS

RECENTLY SOLD

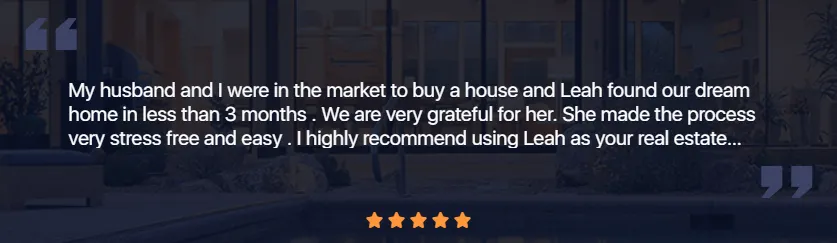

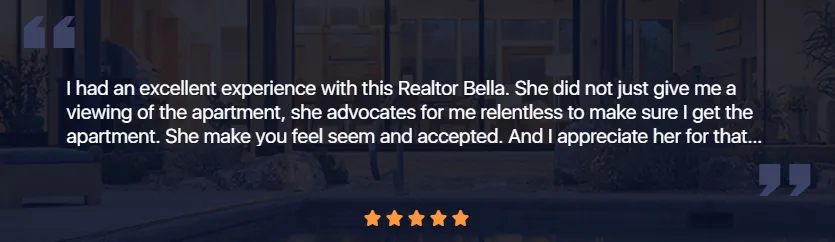

REVIEWS

EXIT Realty First Choice

EXIT Realty First Choice

+1(718) 380-2500

License ID: 49DA1128510

80-15 188th St, Hollis, NY, 11423, USA

Copyright EXIT Realty First Choice© 2025 | All Rights Reserved